CalHFA Dream Program

Goes Live!

February 24th

Get started NOW to ensure you have time to register before it's too late!

***Your pre-approval may take longer than a few days, apply early to ensure you are on time to submit your application.

The 20% down payment provided by CalHFA is considered 'shared equity'. Shared equity examples are:

Borrower is a moderate-income homebuyer

Borrower income less than or equal to 80% of the annual median income

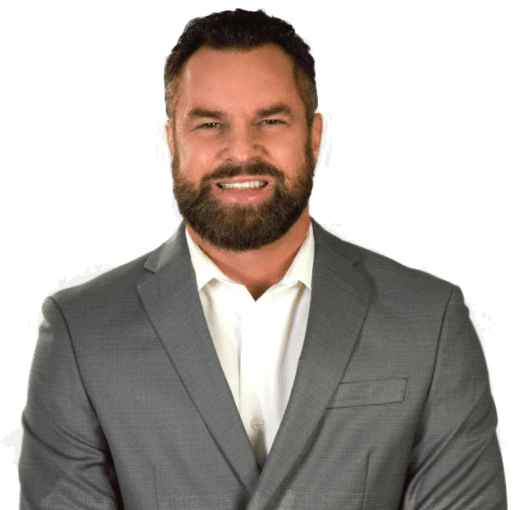

For questions or to start your pre-approval contact Jason today at (909) 921-3623. Or email me at jdelaney@havenloan.net.

You can also start your application online now.

Click the link to get started or call us at (800) 992-1900 Ext 1

The pre-approval requires a full credit report.

We will send you a list of the required documents once your application has been completed